Palawan ProtekTODO Policies

SOLO INSURANCE

-

Learn More

A Personal Accident insurance valid for six (6) months for individuals ages 17-70 years old and covers Death due to Accident and Death due to Motorcycle Accident, with Permanent Disablement or Dismemberment due to Accident.

-

Learn More

A Personal Accident Insurance

customized and offered coverage for

expenses related to death or hospital

confinement required due to a

positive diagnosis of COVID-19. -

Learn More

It gives protection for a term of one (1)

year for individuals ages 17-70 yrs.

old. -

Learn More

It gives protection for a term of one (1)

year for individuals ages 17-70 yrs.

old. -

Learn More

This Personal Accident Insurance provides comprehensive coverage for individuals aged 17-70 years, valid for one (1) year. It includes benefits for Accidental Death, Death due to Motorcycle Accident, Accidental Disablement and Dismemberment, Medical Expense Reimbursement, Burial Expense, and Daily Hospital Confinement (up to 15 days) caused by accidents. Additionally, it offers a Fire Insurance Subsidy for enhanced protection.

-

Learn More

A personal accident insurance policy designed to provide coverage for death-related expenses, with maximum coverage amount of PHP 235,000. The policy is valid for one (1) year and is available to individuals aged 18 to 65 years old.

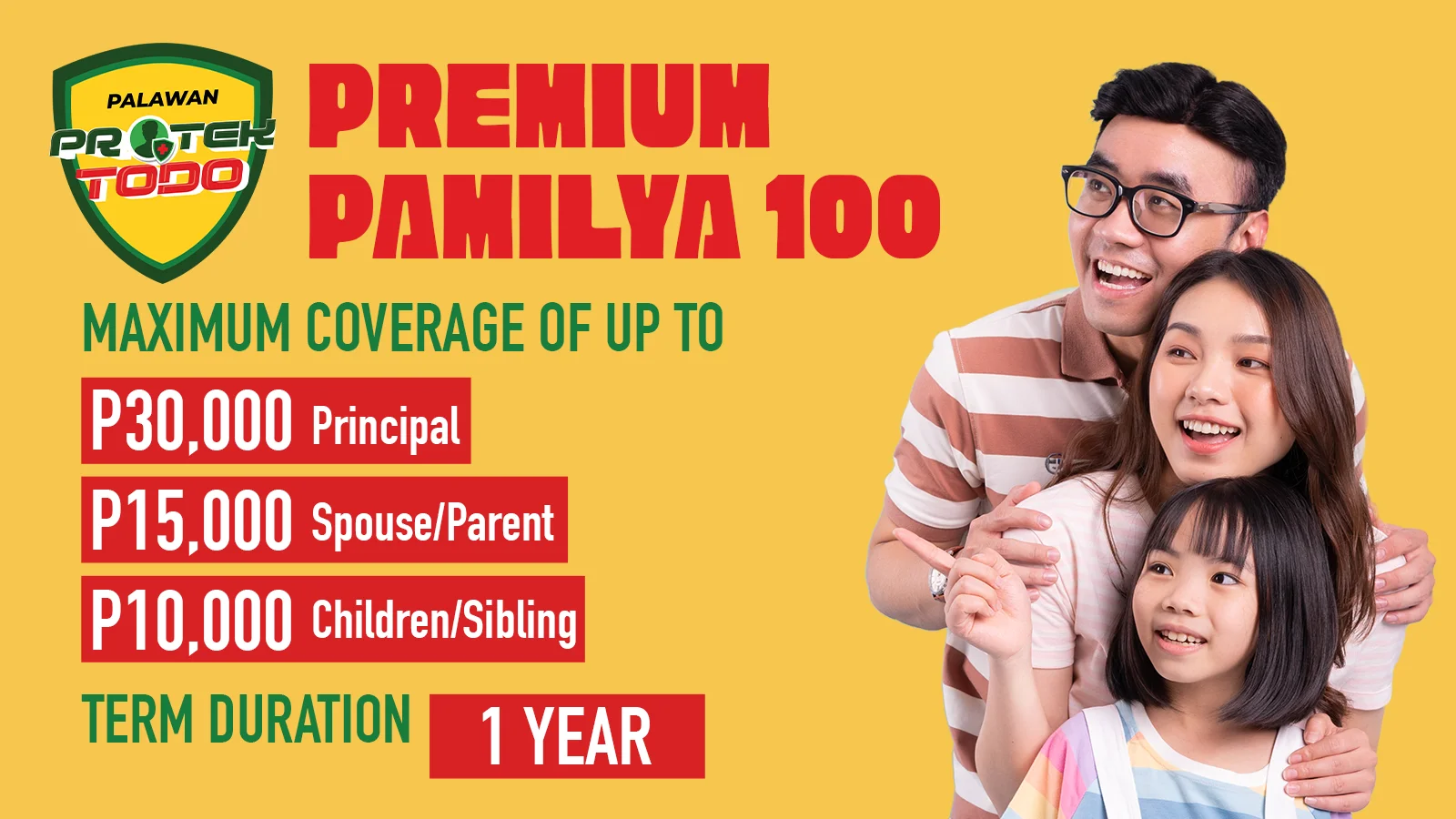

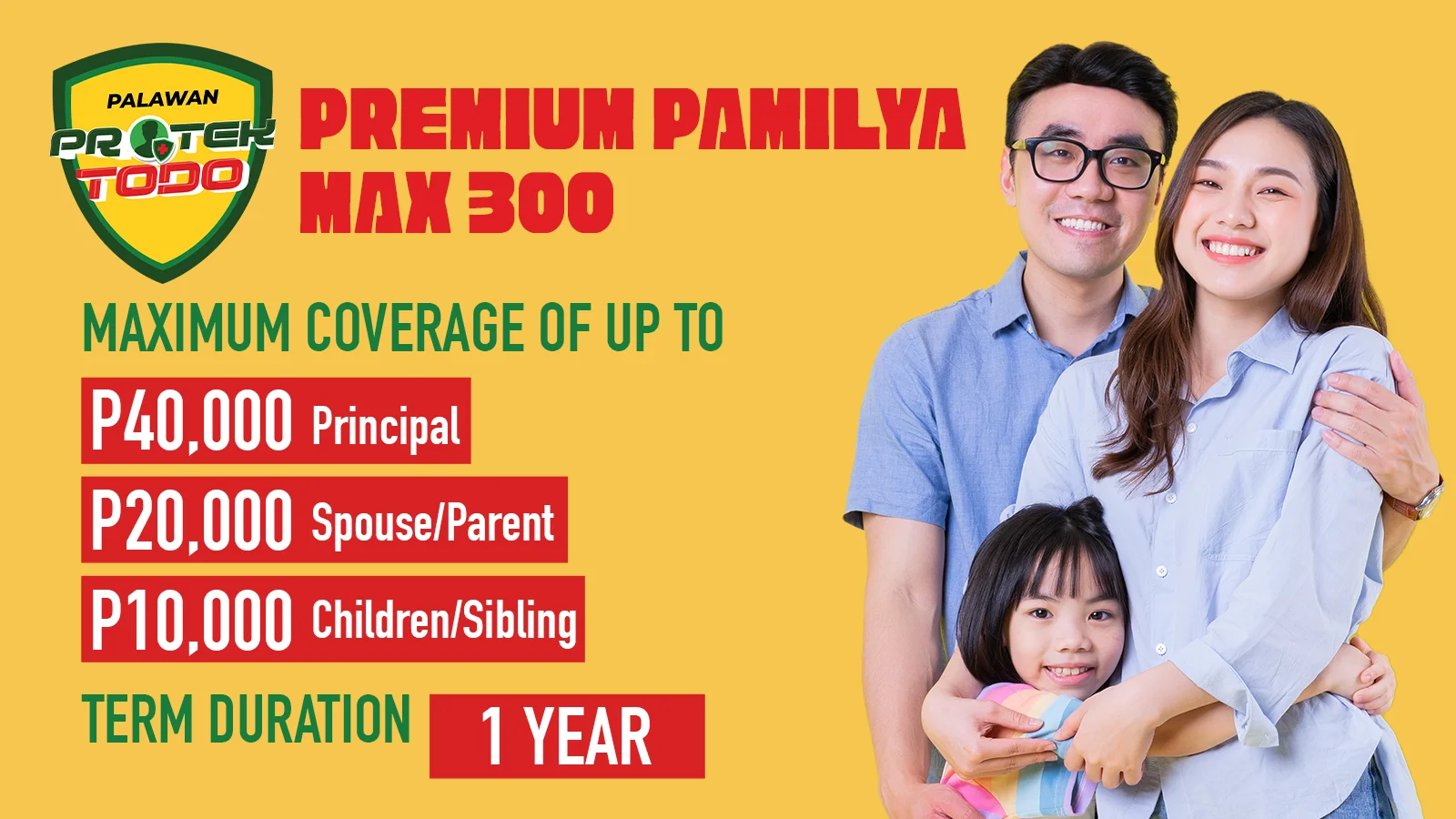

FAMILY INSURANCE

-

Learn More

An accident Insurance package

designed for the family with a term of

one (1) year. It gives security

protection for the insured and his/her

dependents covering Death due to an

Accident, Death due to Motorcycle

Accident with Educational assistance

for the child of the insured and

Permanent Disablement or

Dismemberment due to Accident. -

Learn More

A package insurance design for the family that gives security protection valid for one (1) year.

-

Learn More

An accident insurance product developed for family protection, with a coverage period of one (1) year for the principal insured aged 18 to 65 years old.

This product provides financial protection for the principal insured and qualified dependents, covering Death due to Accident, Death due to Motorcycle Accident, Permanent Disablement or Dismemberment due to Accident, Permanent Disablement or Dismemberment due to Motorcycle Accident, Burial Benefit due to Accidental Death, Educational Assistance for the child of the insured, Cash Assistance for Natural Death or Death due to Sickness, and Fire Assistance for the Principal Insured’s residence.

Maximum coverage is up to PHP 1,000,000.

TRAVEL INSURANCE

-

Learn More

Travel solo with confidence! Whether it’s a medical emergency, trip cancellation, lost baggage, or unexpected delays, Domestic Solo Travel Basic (1 - 7 Days) 39 Insurance provides comprehensive protection for your journey. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—so you can explore the Philippines without worry.

-

Learn More

Travel solo with confidence! Whether it's a medical emergency, trip cancellation, lost baggage, or unexpected delays, Abroad Solo Travel Basic (1 - 7 Days) 39 Insurance provides comprehensive protection for your journey. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—so you can explore the world without worry.

-

Learn More

Travel solo with confidence! Whether it's a medical emergency, trip cancellation, lost baggage, or unexpected delays, Domestic Solo Travel Plus (1-7 days) 59 Insurance provides comprehensive protection for your journey. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—so you can explore the Philippines without worry.

-

Learn More

Travel solo with confidence! Whether it's a medical emergency, trip cancellation, lost baggage, or unexpected delays, Abroad Solo Plus Travel (1 - 7 Days) 79 Insurance provides comprehensive protection for your journey. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—so you can explore the world without worry.

-

Learn More

Travel worry-free with Domestic Pamilya Travel 99 Insurance! Whether it’s a medical emergency, trip cancellation, lost baggage, or delay, we’ve got your family covered. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—plus, declared dependents are covered for up to 25% of the benefits for added protection.

-

Learn More

Travel worry-free with Abroad Pamilya Travel 129 Insurance! Whether it’s a medical emergency, trip cancellation, lost baggage, or delay, we’ve got your family covered. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—plus, declared dependents are covered for up to 25% of the benefits for added protection.

-

Learn More

Domestic Pamilya Plus Travel 149

Travel worry-free with Domestic Pamilya Plus Travel (1-7 days) 149 Insurance! Whether it’s a medical emergency, trip cancellation, lost baggage, or delay, we’ve got your family covered. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—plus, declared dependents are covered for up to 25% of the benefits for added protection.

-

Learn More

Abroad Pamilya Plus Travel 199

Travel worry-free with Abroad Pamilya Plus Travel 199 Insurance! Whether it’s a medical emergency, trip cancellation, lost baggage, or delay, we’ve got your family covered. Enjoy financial security, peace of mind, and emergency assistance whenever you need it—plus, declared dependents are covered for up to 25% of the benefits for added protection.

GROUP INSURANCE

-

Learn More

Grupo ProtekTODO is designed for individuals aged 18-70 years, offering comprehensive coverage for groups. This insurance package is available to Small/Medium Corporations, Associations, Cooperatives, Companies, or Groups with a minimum of 30 enrollees. Coverage is valid for one (1) year, ensuring accessible and reliable protection for your members.

-

Learn More

Grupo ProtekTODO is designed for individuals aged 18-70 years, offering comprehensive coverage for groups. This insurance package is available to Small/Medium Corporations, Associations, Cooperatives, Companies, or Groups with a minimum of 30 enrollees. Coverage is valid for one (1) year, ensuring accessible and reliable protection for your members.

HEALTH INSURANCE

-

Learn More

A one (1)-year medical insurance program for individuals aged 1 to 70 years old. It provides coverage for multiple emergency hospitalizations under a reimbursement-type medical plan, as long as the maximum benefit limit has not been exhausted.

-

Learn More

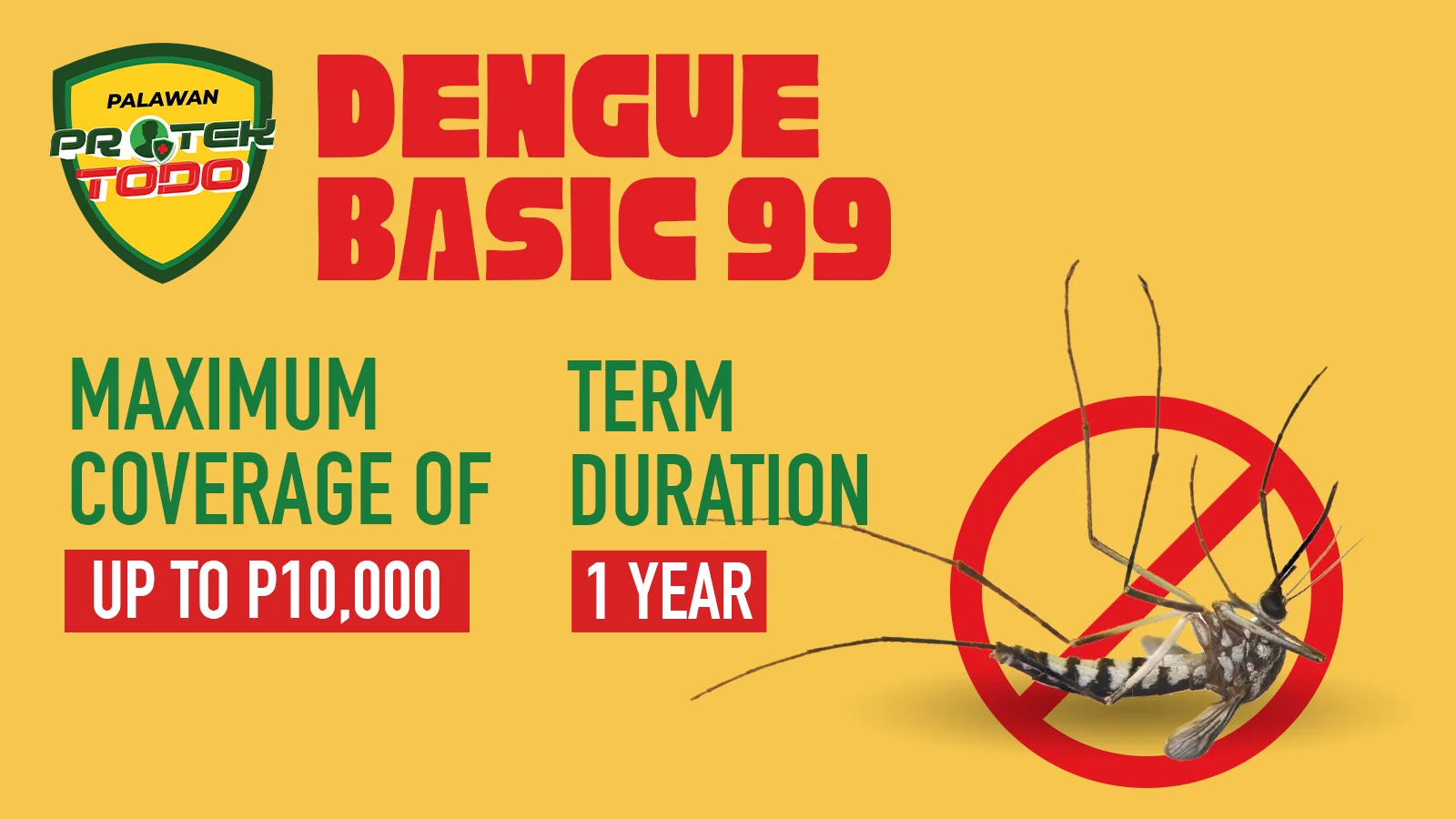

Specifically designed for diagnosed dengue patients with Confinement Allowance and Medical Cost Reimbursement for severe dengue plus an Accidental Death and Permanent Disablement or Dismemberment benefit. Valid for (1) one year for individuals ages 1-70 years old.

-

Learn More

Specifically designed for diagnosed dengue patients with Confinement Allowance and Medical Cost Reimbursement for severe dengue plus an Accidental Death and Permanent Disablement or Dismemberment benefit. Valid for (1) one year for individuals ages 1-70 years old.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

-

Learn More

Be financially prepared for life’s biggest health challenges. Critical Illness Insurance provides a lump-sum cash benefit upon diagnosis of a covered illness like Cancer, Heart Attack, or Stroke—giving you the freedom to use it for treatment, recovery, or everyday needs. It’s your safety net when serious illness strikes, so you can focus on getting better, not worrying about expenses.

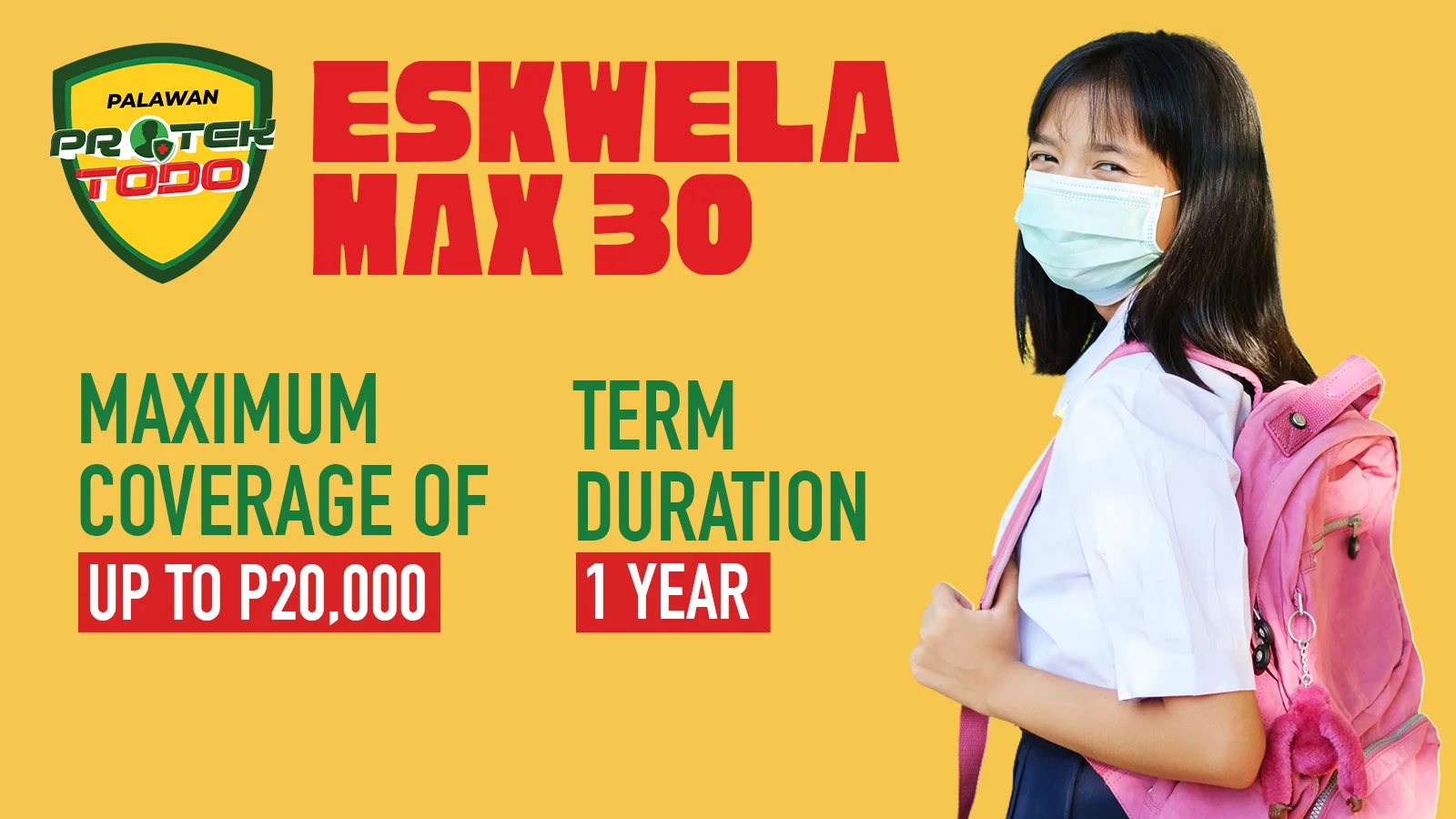

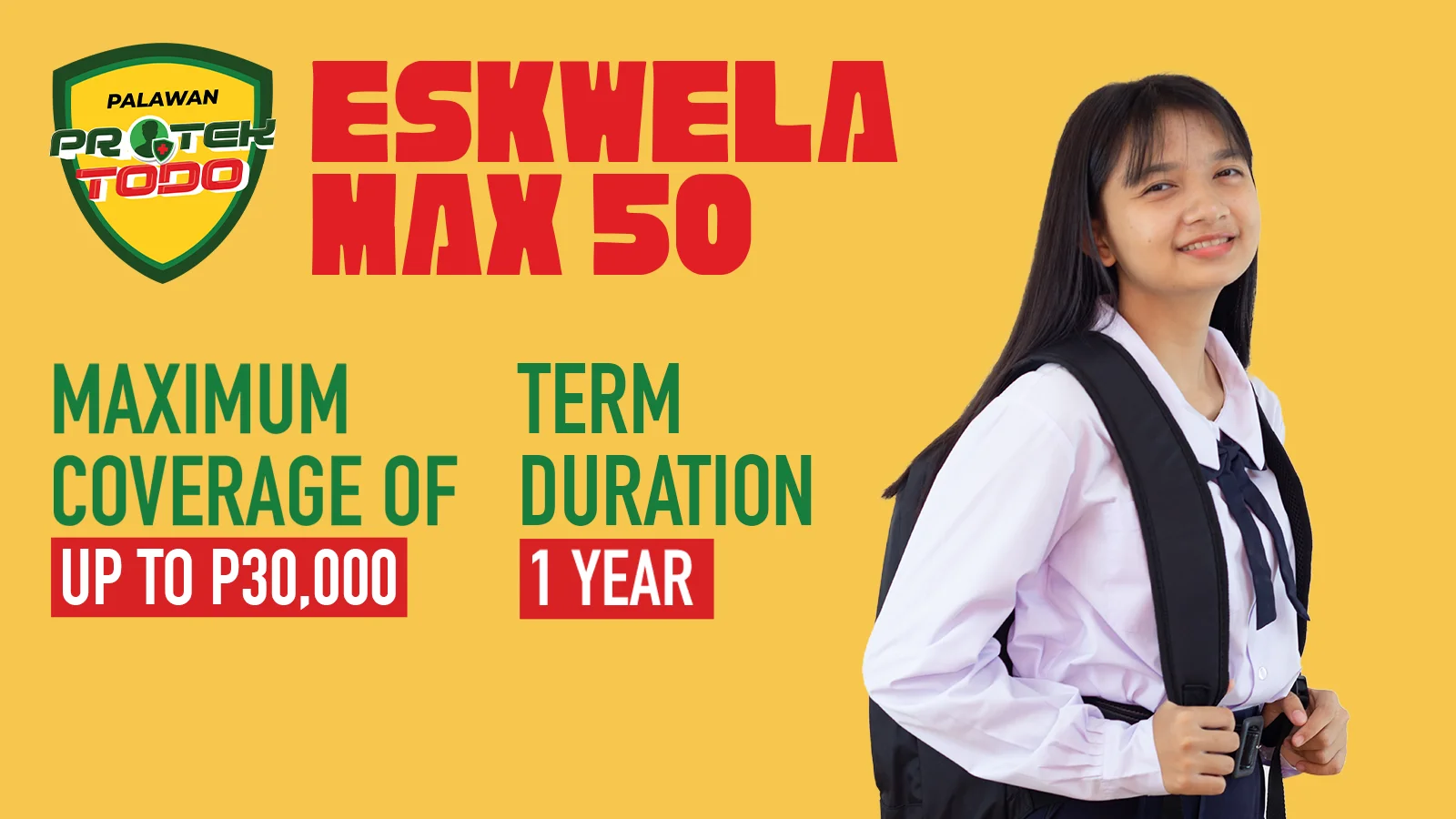

ESKWELA INSURANCE

-

Learn More

A Personal Accident Insurance valid for (1) one year for individuals ages 5-70 years old. Insurance that provides affordable and secured protection specifically made for the student's needs.

-

Learn More

A Personal Accident Insurance valid for (1) one year for individuals ages 5-70 years old. Insurance that provides affordable and secured protection specifically made for the student's needs.

PET INSURANCE

-

Learn More

Me & My Pets (Documented) 2064

A new package designed to help our customers manage the costs of unexpected vet bills and give their pet dog and cat the medical care they need. The package includes coverage for Death & Disability and Medical expenses for both the pet owner and the pet dog or cat. Valid for (1) one year for pet owners aged 18-60 years old and pets aged 0 to 7 years old with proof of ownership and/or PCCI.

-

Learn More

Me & My Pets (Documented & Senior) 3064

A new package designed to help our customers manage the costs of unexpected vet bills and give their pet dog and cat the medical care they need. The package includes coverage for Death & Disability and Medical expenses for both the pet owner and the pet dog or cat. Valid for (1) one year for pet owners aged 18-60 years old and pets aged 8 years to 10 years old with proof of ownership and/or PCCI.

-

Learn More

Me & My Pets (Undocumented) 3064

A new package designed to help our customers manage the costs of unexpected vet bills and give their pet dog and cat the medical care they need. The package includes coverage for Death & Disability and Medical expenses for both the pet owner and the pet dog or cat. Valid for (1) one year for pet owners aged 18-60 years old and pets aged 0 to 7 years old wherein a pet record is not necessary.

-

Learn More

Me & My Pets (Undocumented & Senior) 4064

A new package designed to help our customers manage the costs of unexpected vet bills and give their pet dog and cat the medical care they need. The package includes coverage for Death & Disability and Medical expenses for both the pet owner and the pet dog or cat. Valid for (1) one year for pet owners aged 18-60 years old and pets aged 8 years to 10 years old wherein a pet record is not necessary.

NEGOSYO INSURANCE

-

Learn More

This SME Insurance offers one (1) year of protection for individuals aged 18-64 years. Designed to safeguard business assets and properties against natural disasters, it ensures comprehensive coverage for small and medium enterprises. Policyholders are limited to a maximum of one (1) policy.

-

Learn More

This SME Insurance offers one (1) year of protection for individuals aged 18-64 years. Designed to safeguard business assets and properties against natural disasters, it ensures comprehensive coverage for small and medium enterprises. Policyholders are limited to a maximum of one (1) policy.

EMPLOYEE INSURANCE

-

Learn More

A Personal Accident insurance

designed to provides protection for

any person employed to do household

work for an employer.

SANGLA INSURANCE

-

Learn More

Palawan ProtekTODO introduces an affordable insurance solution designed specifically for the security and protection of our valued pawners. Alongside our enhanced Personal Accident Insurance, we proudly offer Sangla ProtekTODO—a reliable and convenient insurance package tailored to meet the needs of our pawning customers.

CTPL INSURANCE

-

Learn More

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

MyCTPL (Light & Medium Truck) 660

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

MyCTPL (Taxi/PUJ/Mini Bus) 1,150

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

MyCTPL (Heavy Truck & Private Bus) 1,250

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

-

Learn More

MyCTPL (PUB/Tourist Bus) 1,500

Compulsory Third Party Liability (CTPL) is a mandatory insurance policy required by the Land Transportation Office (LTO) for all vehicle owners prior to vehicle registration. It provides financial protection to the policyholder against liabilities arising from the injury or death of third parties caused by accidents involving the insured vehicle.

FIRE INSURANCE

-

Learn More

This Fire Insurance offers one (1) year of exclusive coverage for residential properties, providing financial protection against fire-related incidents. Each policyholder may hold only one (1) policy.

How to Enroll (Over-the-Counter)

General Enrollment Steps:

- Complete the Enrollment Form: Fill out and sign the Palawan ProtekTODO Enrollment Form.

- Pay the Premium: Settle the premium amount for the chosen insurance policy. (Note: Present your Suki Card to avail of a 5% discount.)

- Receive Confirmation: Sign and receive the Confirmation of Cover (COC) as proof of enrollment.

Additional Guidelines for Eskwela MAX 30 & Eskwela MAX 50:

- Customers enrolling in these policies must be students at the time of enrollment.

Batch Enrollment Guidelines:

- Eligibility: A 10% discount on the policy premium is available for batch enrollments with a minimum of 30 enrollees.

- Submission of Forms: The group representative must either submit completed Enrollment Forms for all members or use the Batch Enrollment Form available at Palawan Branches.

- Payment: Settle the total premium for all policies.

- Confirmation: Sign and receive the Confirmation of Cover (COC) for the group.

How to Enroll (Shopee/Lazada)

- Open Shopee or Lazada App

- Select an insurance policy

- Once the purchase is successful, copy the purchase voucher code (Shopee=in app / Lazada=email)”

- Go to Palawan ProtekTODO Microsite for enrollment

- Click “Enrollment”

- Enter the “Voucher Code” provided by Shopee/Lazada

- Input the required customer details

- Click “Submit”

ProtekTODO Discounts

- Suki cardholders are entitled to a 5% discount on any ProtekTODO policy, except for the Sangla and Kasambahay policies.

- Policy renewals qualify for a 10% discount on any ProtekTODO policy.

- Batch enrollment offers a 10% discount on each policy premium for groups with a minimum of 30 enrollees.

How to apply for claim

- Go to any Palawan Pawnshop branch nearest to you.

- The claim should be reported within thirty (30) days from the date of the incident.

- Fill out the Notice of Claim available at the branch.

- Once the incident is evaluated at the branch and subject for a claim, submit original copies of the documents for a fast evaluation of the claim.

(Lacking documents are given a maximum of sixty (60) days from the date of the incident to complete.) - You will be notified through your given mobile number upon the status of the claim.

- All claims will be payable in cash and will be released at the branch where the claim was filed.

For Personal Accident Claims*

- Confirmation of Cover

- Notice of Claim

- Police/Incident Report

- Birth/Death Certificate (Insured)

- Medical Certificate (if necessary)

- Clinical Abstract (if necessary)

- Marriage License (if the claimant is Insured's Legal Spouse)

- Valid IDs (Insured and Claimant), School ID for Eskwela Max 30 & Eskwela Max 50

For Natural Death/ Death due to Sickness Claim*

- Confirmation of Cover

- Notice of Claim

- Birth/Death Certificate

- Marriage License (if the claimant is insured's Legal Spouse)

- Medical Certificate (if necessary)

- Clinical Abstract (if necessary)

- Valid ID (Insured and Claimant)

For Cash Fire Assistance Claim*

- Original Confirmation of Cover

- Notice of Claim

- Barangay Certificate that Insured is a fire victim

- Fire incident report from Bureau of Fire Protection

- Picture(s) of fire loss (2 full/whole shot & 2 medium close-up)

- Valid ID (Principal insured)

- Other documents that may be required by the Insurance Provider.

For Accidental Medical Reimbursement Claim*

- Original Confirmation of Cover

- Notice of Claim

- Incident Report or Police report (ex. vehicular accident)

- Medical Prescription and Official receipts

- Hospital Statement of Account or Billing

- Valid ID's of the insured & claimant

- Medical Certificate or Duly accomplished Attending Physician's report

- Other documents that may be required by the Insurance Provider.

Additional Documents for Claimant/Beneficiary*

- Legal Spouse or Wife

Marriage Certificate

Valid ID - Live In Partner

Affidavit of Cohabitation

Valid ID - Children/Siblings

Birth Certificate

Valid ID - Parent (Mother/Father)

Valid ID